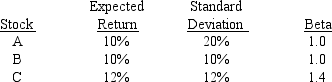

Consider the following information for three stocks, A, B, and C.The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlations are all between 0 and 1.

Portfolio AB has half of its funds invested in Stock A and half in Stock B.Portfolio ABC has one third of its funds invested in each of the three stocks.The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns.Which of the following statements is CORRECT?

Definitions:

Electrode

A conductor through which electric current enters or leaves a non-metallic medium, such as an electrolytic cell, arc lamp, or semiconductor.

Current Flows

The movement of electric charge carriers, such as electrons, through a conductor.

Field Winding

Coils of wire (windings) placed on the field poles of a generator or motor that create a magnetic field when electric current flows through them.

Voltage Regulator

A device that controls the amount of current that is supplied to the field winding in an AC generator.

Q10: Bostian, Inc.has total assets of $625, 000.Its

Q18: Under normal conditions, which of the following

Q24: The value of Broadway-Brooks Inc.'s operations is

Q55: Assume that the market is in equilibrium

Q64: Which of the following statements is CORRECT?<br>A)

Q69: Jessie's Bobcat Rentals' operations provided a negative

Q73: Which of the following statements is CORRECT?<br>A)

Q74: Joel Foster is the portfolio manager of

Q98: Suppose you borrowed $15, 000 at a

Q134: Consider the following information for three stocks,