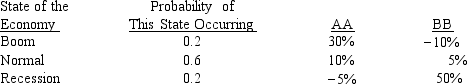

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational, risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

Definitions:

Direct Labour Rate Variance

The difference between the actual wages paid to workers and the standard cost of those wages for the actual hours worked.

Labour Efficiency Variance

A metric used to measure the difference between the actual hours worked and the standard hours expected to complete a task.

Standard Rate (SR)

Standard Rate (SR) refers to a predefined or established cost or value used in financial and operational calculations, often applied in budgeting and cost accounting.

Actual Hours (AH)

The real number of hours worked or required to complete a specific task or project, as opposed to estimated or planned hours.

Q6: Megan Ross holds the following portfolio:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3581/.jpg"

Q19: Cazden Motors' stock is trading at $30

Q25: Below is the common equity section (in

Q31: Young & Liu Inc.'s free cash flow

Q31: Hart Corp.is considering a project that has

Q61: The primary reason the annual report is

Q61: When working with the CAPM, which of

Q72: If an investment project would make use

Q74: Some of the cash flows shown on

Q135: The Y-axis intercept of the SML indicates