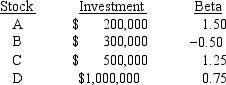

Consider the following information and then calculate the required rate of return for the Universal Investment Fund, which holds 4 stocks.The market's required rate of return is 13.25%, the risk-free rate is 7.00%, and the Fund's assets are as follows:

Definitions:

Variety of Data

The collection of data in different forms or from various sources, encompassing multiple types, categories, or characteristics.

Charismatic

Possessing an exceptional personal charm or appeal that inspires devotion in others.

Vivacious

Characterized by high spirits and lively energy, often describing a person's demeanor.

Subjective

Based on or influenced by personal feelings, tastes, or opinions rather than external facts.

Q5: Operating plans sketch out broad approaches for

Q5: Recession, inflation, and high interest rates are

Q25: Under certain conditions, a project may have

Q31: In cash flow estimation, the existence of

Q43: The required return for Williamson Heating's stock

Q48: Based on the corporate valuation model, Bizzaro

Q64: At a rate of 6.5%, what is

Q67: Suppose you deposited $5, 000 in a

Q68: Firms raise capital at the total corporate

Q72: Stocks A and B have the following