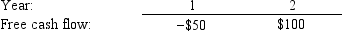

The free cash flows (in millions) shown below are forecast by Parker & Sons.If the weighted average cost of capital is 11% and FCF is expected to grow at a rate of 5% after Year 2, what is the Year 0 value of operations, in millions? Assume that the ROIC is expected to remain constant in Year 2 and beyond (and do not make any half-year adjustments) .

Definitions:

Preferences

Individual likes or choices, often reflecting a person's values or desired outcomes.

Priorities

The determination of the order for dealing with tasks, items, or concepts according to their relative importance.

First Impressions

The initial perception or judgment formed about someone or something upon the first encounter.

Expectations

Entails beliefs or prospects about future events, often based on past experiences or societal norms.

Q4: Which of the following statements is CORRECT?<br>A)

Q5: Suppose you believe that Basso Inc.'s stock

Q14: Other things held constant, the value of

Q34: Refer to Exhibit 3.1.What is the firm's

Q45: Martin Manufacturing is considering two normal, equally

Q49: The Jameson Company just paid a dividend

Q52: Companies HD and LD have identical tax

Q62: Reed Enterprises is considering a project that

Q76: A stock with a beta equal to

Q89: You have just purchased a U.S.Treasury bond