An analyst wants to use the Black-Scholes model to value call options on the stock of Heath Corporation based on the following data:

•The price of the stock is $40.

•The strike price of the option is $40.

•The option matures in 3 months (t = 0.25) .

•The standard deviation of the stock's returns is 0.40, and the variance is 0.16.

•The risk-free rate is 6%.

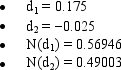

Given this information, the analyst then calculated the following necessary components of the Black-Scholes model:

N(d?) and N(d?) represent areas under a standard normal distribution function.Using the Black-Scholes model, what is the value of the call option?

Definitions:

Protective Cushion

A safeguarding structure or material that mitigates impact or pressure, often found in biological contexts like the pads of tissue that protect underlying organs.

Elongated Fibers

Refers to cells that have been stretched or lengthened, often found in muscle and connective tissues.

Muscular Tissue

A tissue composed of fibers accountable for producing force and motion in the body, including movement of organs and the body itself.

Specialized to Contract

Describes cells or tissues, such as muscle cells, that are adapted to shorten or generate force, playing a crucial role in movement and support.

Q4: Which of the following statements is CORRECT?<br>A)

Q15: Which of the following statements is CORRECT?<br>A)

Q27: Gere Furniture forecasts a free cash flow

Q32: The regular payback method is deficient in

Q39: Cartwright Communications is considering making a change

Q46: If you randomly select stocks and add

Q48: It is possible that two firms could

Q56: DeVault Services recently hired you as a

Q65: Superior analytical techniques, such as NPV, used

Q82: Firm J's earnings and stock price tend