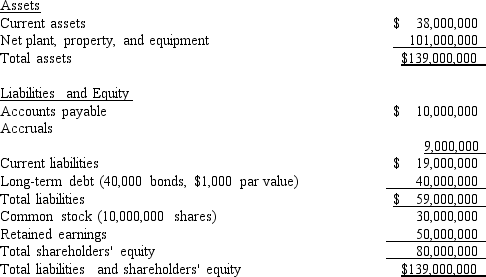

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital.The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1, 000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00.The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the after-tax cost of debt?

Definitions:

Externalities

Unintended financial outcomes affecting individuals not directly engaged, potentially leading to good or bad impacts.

External Costs

Costs that are not borne by the producer or consumer of a good or service, but by society or the environment.

MSC (Marginal Social Cost)

The total cost to society of producing an additional unit of a good or service, including both the private costs and any external costs.

Efficient Level

Refers to the point at which a system, process, or economy operates at maximum productivity with minimal waste and expense.

Q3: The slope of the SML is determined

Q19: If an investor buys enough stocks, he

Q28: Last year Baron Enterprises had $350 million

Q29: Laramie Trucking's CEO is considering a change

Q40: The cash flows associated with common stock

Q51: Dyer Furniture is expected to pay a

Q70: Field Industries' outstanding bonds have a 25-year

Q99: Which of the following statements is CORRECT?<br>A)

Q112: Fontana Painting had the following data for

Q140: Stocks A and B are quite similar: