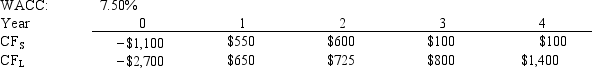

Current Design Co.is considering two mutually exclusive, equally risky, and not repeatable projects, S and L.Their cash flows are shown below.The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV.If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs.NPV will have no effect on the value gained or lost.

Definitions:

American Federation of Labor

An early 20th-century national federation of labor unions in the United States, focused on better wages, hours, and working conditions.

Conservative

A belief system advocating for the preservation of conventional social norms and structures.

Pure Food and Drug Act

A 1906 U.S. law aimed at regulating the production and sale of food and medicine, marking the beginning of federal consumer protection in the United States.

Federal Government

The national government of a federated state, responsible for the country's political authority and realization of its laws.

Q17: For capital budgeting and cost of capital

Q19: Which of the following statements is CORRECT?<br>A)

Q19: If an investor buys enough stocks, he

Q29: VR Corporation has the opportunity to invest

Q36: The two cardinal rules that financial analysts

Q54: Taylor Inc., the company you work for,

Q55: Assume that you are an intern with

Q78: National Advertising just paid a dividend of

Q92: You are considering two mutually exclusive, equally

Q102: The calculated cost of trade credit for