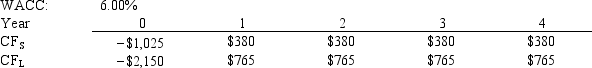

Murray Inc.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.The CEO wants to use the IRR criterion, while the CFO favors the NPV method.You were hired to advise Murray on the best procedure.If the wrong decision criterion is used, how much potential value would Murray lose?

Definitions:

Profession

A vocation requiring specialized knowledge and often long and intensive academic preparation, characterized by a commitment to service and a set of ethical standards.

Presidency

The office or position of the president, often referring to the executive head of a country or organization.

Body Image

The perception and attitude an individual holds towards their own body's appearance and functionality.

Urban

Pertaining to a city or town, often characterized by higher population density and vast human features in comparison to areas outside of cities.

Q7: Which of the following is NOT a

Q9: The announcement of an increase in the

Q11: Which of the following statements is CORRECT?<br>A)

Q19: Carby Hardware has an outstanding issue of

Q31: When estimating the cost of equity by

Q37: Reynolds Paper Products Corporation follows a strict

Q66: For a project with one initial cash

Q86: Taylor Inc.estimates that its average-risk projects have

Q101: Which of the following is most likely

Q110: Portfolio A has but one stock, while