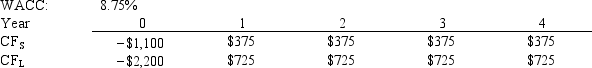

Silverman Co.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Sample Mean Difference

The difference between the average values of two samples drawn from a population.

Populations

The entire pool from which a statistical sample is drawn and to which inferences are aimed in statistics.

Expected Value

The long-term average or mean of a random variable over many trials or occurrences.

Sampling Distribution

The arrangement of probability for a specific statistic, following the analysis of a randomly selected sample.

Q8: Which of the following statements is CORRECT?

Q17: The ability to alter our skills and

Q32: Adams Inc.has the following data: rRF =

Q40: Sommers Co.'s bonds currently sell for $1,

Q53: Suppose Stan holds a portfolio consisting of

Q54: Taylor Inc., the company you work for,

Q61: Your friend is considering adding one additional

Q70: Portfolio AB was created by investing in

Q72: Short-term financing is riskier than long-term financing

Q123: In historical data, we see that investments