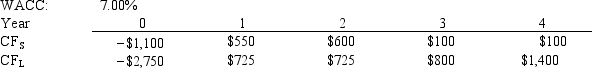

Langton Inc.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone.In other words, what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

Definitions:

Blogging

The act of writing for a blog, a web-based platform where individuals or organizations can publish regular articles, commentary, or other content.

Microblogging

A form of blogging where users publish short pieces of digital content—which could be text, pictures, links, short videos, or other media on the Internet.

Business Communication

The sharing of information within an organization for commercial benefits, encompassing various methods including meetings, emails, reports, and presentations.

Three-Step Process

A procedure or method that is divided into three sequential stages or phases to achieve a particular goal or solve a problem.

Q1: Which of the following statements is CORRECT?<br>A)

Q1: A rapid build-up of inventories normally requires

Q16: If a firm with a positive net

Q25: Bond A has a 9% annual coupon,

Q30: Which of the following statements is CORRECT?<br>A)

Q35: Nichols Inc.is considering a project that has

Q39: Two conditions are used to determine whether

Q41: McLeod Inc.is considering an investment that has

Q46: The constant growth DCF model used to

Q80: If a firm's stockholders are given the