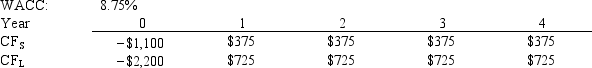

Silverman Co.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Panic Attack

A sudden onset of intense fear or discomfort, where an individual may experience physical symptoms such as rapid heartbeat and sweating.

Phobia

An extreme or irrational fear or aversion to something, significantly impacting an individual's daily life.

Compulsion

An irresistible urge to perform an irrational or a seemingly senseless act repeatedly, often linked to obsessive-compulsive disorder.

Phobia

A phobia is an extreme or irrational fear of or aversion to something, significantly affecting a person's life and behavior.

Q11: Which of the following statements is CORRECT?<br>A)

Q12: Companies can issue different classes of common

Q29: Which of the following statements is CORRECT?<br>A)

Q37: To help estimate its cost of common

Q41: Which of the following statements is CORRECT?<br>A)

Q69: The graphical probability distribution of ROE for

Q71: When considering two mutually exclusive projects, the

Q81: Donald Gilmore has $100, 000 invested in

Q89: Cash is often referred to as a

Q114: If the price of money (e.g., interest