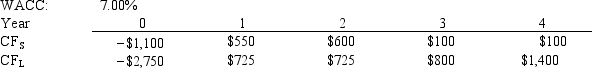

Langton Inc.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone.In other words, what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

Definitions:

Confidence

The feeling or belief that one can rely on someone or something; firm trust.

Functional Fixedness

A cognitive bias that limits a person's ability to use an object only in the way it is traditionally used.

Confirmation Bias

The habit of looking for, interpreting, prioritizing, and recalling data in a way that reinforces one's already held convictions or assumptions.

Gamble

The act of risking something of value on the outcome of an event in the hope of gaining something of greater value.

Q7: Markman & Sons is considering Projects S

Q10: Morales Publishing's tax rate is 40%, its

Q11: S.-based importer, Zarb Inc., makes a purchase

Q14: Other things held constant, the value of

Q15: In a study of the effects of

Q23: Franklin Corporation is expected to pay a

Q26: As a firm's sales grow, its current

Q45: Which of the following researchers did NOT

Q90: Funds acquired by the firm through retaining

Q94: A conservative current operating asset financing approach