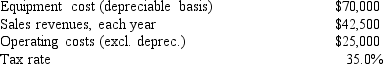

Whitestone Products is considering a new project whose data are shown below.The required equipment has a 3-year tax life, and the accelerated rates for such property are 33.33%, 44.45%, 14.81%, and 7.41% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow?

Definitions:

Intertemporal Price Discrimination

A pricing strategy where a seller changes prices over time for the same product or service to different consumers, aiming to maximize profits by targeting price sensitivity at different time periods.

Cellular Phone

A wireless handheld device that allows users to make and receive calls and access data services over a cellular network.

Price Discrimination

The practice of selling the same product to different customers at different prices for reasons not associated with cost differences.

Consumer Surplus

The difference between what consumers are willing to pay for a good or service and what they actually pay, representing the benefit to consumers.

Q6: The capital intensity ratio is generally defined

Q23: Learning that Freud is the father of

Q31: In cash flow estimation, the existence of

Q31: Last year National Aeronautics had a FA/Sales

Q34: Which of the following procedures does the

Q52: Arnold Inc.purchases merchandise on terms of 2/10

Q67: Which of the following statements is CORRECT?<br>A)

Q72: Merriwether Building has operating income of $20

Q86: Which of the following is most likely

Q135: Accruals are "free" capital in the sense