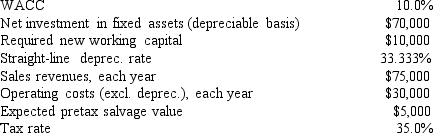

Sheridan Films is considering some new equipment whose data are shown below.The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down.Also, some new working capital would be required, but it would be recovered at the end of the project's life.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV?

Definitions:

Iris

The colored part of the eye surrounding the pupil that controls the amount of light entering the eye.

Opening

An aperture or gap that allows access, passage, or a view through something.

Light

A type of electromagnetic radiation that is visible to the human eye, responsible for the sense of sight.

Eye Sockets

The bony structures in the skull that house and protect the eyes, also known as orbits.

Q1: A rapid build-up of inventories normally requires

Q5: Which of the following will cause an

Q5: The last dividend paid by Coppard Inc.was

Q11: Which of the following statements is CORRECT?<br>A)

Q15: Which of the following statement completions is

Q28: Last year Baron Enterprises had $350 million

Q35: Cognitive memory is also called _ memory.<br>A)

Q36: An increase in any current asset must

Q38: Habituation is a specific example of _

Q77: The overriding goal of inventory management is