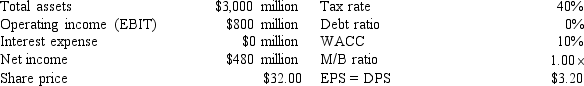

The following information has been presented to you about the Gibson Corporation.

The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) .The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%.If the company makes this change, what would be the total market value (in millions) of the firm?

Definitions:

Frustration of Purpose

A legal defense used in contract law where unforeseen events render the contract's purpose void and impracticable, absolving the parties from their obligations.

Coronation

The ceremony of crowning a sovereign or a sovereign's consort.

Equitable Remedies

Remedies granted by courts in cases where monetary damages are insufficient, often involving actions like injunctions or specific performance.

England

A country that is part of the United Kingdom, known for its rich history, cultural contributions, and legal system.

Q24: Opportunity costs include those cash inflows that

Q27: Dishabituation has been used with infants to

Q33: Briefly describe the changes that occur within

Q33: In a seminal study, Tulving (1982) found

Q37: Reynolds Paper Products Corporation follows a strict

Q45: The standard deviation is a better measure

Q48: Since depreciation is a non-cash charge, it

Q58: Weatherall Enterprises has no debt or preferred

Q67: Which of the following statements is CORRECT?<br>A)

Q72: Merriwether Building has operating income of $20