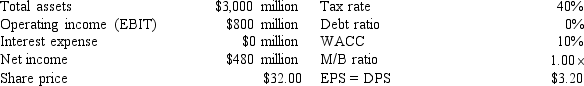

The following information has been presented to you about the Gibson Corporation.

The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) .The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%.If the company makes this change, what would be the total market value (in millions) of the firm?

Definitions:

Price Elasticity

A gauge of the responsiveness of the amount of a product desired to alterations in its cost, reflecting demand's sensitivity to changes in price.

Revenue

The comprehensive total of money a firm collects from offering goods or services in a pre-determined period.

Total Revenue

The total amount of money a company receives from its business activities, calculated by multiplying the price of goods or services by the number of units sold.

Baseball Stadium

A specialized venue designed primarily for hosting baseball games.

Q4: Mark Packard and James McGaugh's 1996 research

Q6: Sensitization and habituation are different from one

Q8: Which of the following is not true

Q17: Categorical perception of phonemes is very important

Q21: Robert Johnston (1993) tested whether or not

Q30: Projects A and B have identical expected

Q42: The results of Tulving's 1982 study showed

Q42: Tashakori Trucking, a U.S.-based company, is considering

Q46: The large prefrontal association cortex is well

Q75: A firm's collection policy, i.e., the procedures