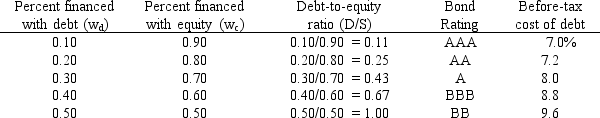

LeCompte Learning Solutions is considering making a change to its capital structure in hopes of increasing its value.The company's capital structure consists of debt and common stock.In order to estimate the cost of debt, the company has produced the following table:

The company uses the CAPM to estimate its cost of common equity, rs.The risk-free rate is 5% and the market risk premium is 6%.LeCompte estimates that if it had no debt its beta would be 1.0.(Its "unlevered beta, " bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is LeCompte's optimal capital structure, and what is the firm's cost of capital at this optimal capital structure?

Definitions:

Rate of Return

The returns or deficits generated by an investment over a certain span, represented as a percentage of the initial financial commitment.

Annual Dividend

The total dividend payment a company makes to its shareholders in a year, often expressed on a per share basis.

Investor's Return

The amount of profit or loss an investor realizes on an investment, reflecting the overall performance and earnings from the investment.

Dividend Value

The portion of a company's earnings distributed to shareholders, typically in the form of cash payments.

Q7: North Construction had $850 million of sales

Q32: Suppose a firm's CFO thinks that an

Q46: Human evidence of unconscious perceptual skill learning

Q47: Suppose 90-day investments in Britain have a

Q47: Which of the following statements is CORRECT?<br>A)

Q48: It is possible that two firms could

Q49: The IRR of normal Project X is

Q52: The last dividend paid by Wilden Corporation

Q53: The optimal distribution policy strikes that balance

Q110: Which of the following is NOT directly