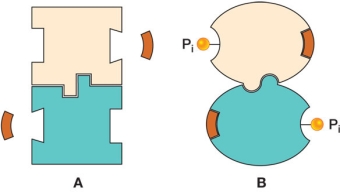

Figure A shows a protein consisting of two identical subunits.Figure B shows the same protein after each subunit has been covalently modified with a phosphate group.  Based on the activities shown in the diagrams, what biological advantage does this protein gain by having the ability to undergo a reversible phosphorylation-dephosphorylation reaction?

Based on the activities shown in the diagrams, what biological advantage does this protein gain by having the ability to undergo a reversible phosphorylation-dephosphorylation reaction?

Definitions:

Net Working Capital

The contrast between a corporation's short-term assets and its short-term debts, indicating its immediate financial health.

Non-Eligible Dividends

Dividends that are paid out by companies from earnings that have not been taxed at the corporate level and are subject to different tax treatment at the receiver's end compared to eligible dividends.

Capital Gains

The profit earned from the sale of an asset, such as stocks, bonds, or real estate, when the sale price exceeds the purchase price.

Marginal Tax Rates

are the rates at which the last dollar of a taxpayer’s income is taxed, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Q68: What is the molarity of 14.5 g

Q88: Refer to the diagram of a phospholipid

Q114: Fats and proteins share the use of

Q125: Metabolism is<br>A) the consumption of energy.<br>B) the

Q147: Scientists interested in human biology typically perform

Q161: Some trace metals such as molybdenum and

Q170: Refer to the table and figures below.

Q170: Which statement is true?<br>A) The diversity of

Q228: Pesticides are not used in organic farming,

Q231: Which is not a correct monomers →