NOTE: This Problem Requires Present Value Information As an Analyst You Wish to Restate Paperclip's Operating Leases

NOTE: This problem requires present value information.

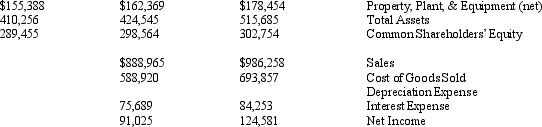

Paperclip Company manufactures office equipment and supplies throughout the U.S. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. The company's tax rate is 35%. Listed below is selected financial data for Paperclip and the company's operating lease disclosure.

Papercli Conl.

Papercli Conl.

Operating Lease Dischsure

(amounts in thousands)

Operating Lease Comunitments

at the end of 2005

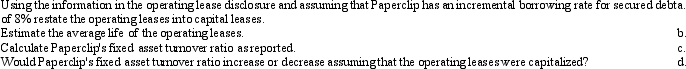

As an analyst you wish to restate Paperclip's operating leases into capital leases. Required:

Definitions:

Heights of Men

The distribution of vertical measurements of adult males in a specific population or group.

Standard Deviation

A parameter reflecting the extent of diversity or spread in a group of numbers.

Normally Distributed

A type of distribution in which data points are symmetrically distributed around the mean, forming a bell-shaped curve.

Standard Deviation

A measure that quantifies the amount of variation or dispersion of a set of values from the mean.

Q10: When firms use derivatives effectively to manage

Q10: One sign that a company may be

Q16: Below is selected information from DXI's

Q17: A Company that uses FIFO will find

Q19: Profit Corp. manufactures telecommunication equipment and has

Q39: Ashley Company purchased 2,000 of the 10,000

Q55: Accountants use reserve accounts for various reasons,

Q57: In which of the following patient care

Q57: Molitor Company currently has a current ratio

Q59: Which of the following best describes the