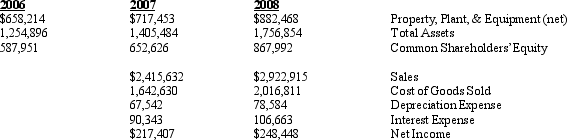

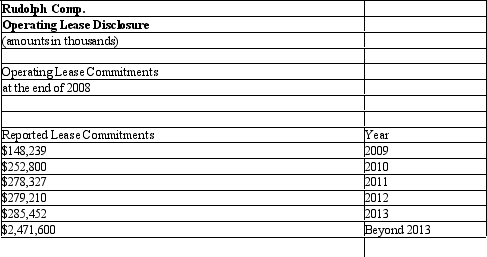

NOTE: These multiple choice questions require present value information. Rudolph Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Randolph's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Rudolph and a portion of the company's operating lease footnote.

Using the information provided by Rudolph Corporation calculate the company's 2008 fixed asset ratio.

Using the information provided by Rudolph Corporation calculate the company's 2008 fixed asset ratio.

Definitions:

Profit

The financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses, costs, and taxes needed to sustain the activity.

Inflation Rate

The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

Risk-free Rate

The theoretical return on investment with no risk of financial loss, often represented by the yield on government securities.

Exchange Rate

The price of one country's currency in terms of another, essential for currency exchange and international trade.

Q3: An analyst can view the revenues to

Q13: Antibody titers are performed on phlebotomists to

Q15: Most publicly traded firms in the United

Q31: Lymph nodes are located in all of

Q32: Specimens collected in evacuated tubes are all

Q33: Discuss the correlations that have been found

Q42: Solo Corp. purchased $500,000 of bonds for

Q49: One common problem with the current ratio

Q52: Note that this topic is covered in

Q89: Testosterone<br>A)Adrenal cortex<br>B)Adrenal medulla<br>C)Ovaries<br>D)Pituitary gland<br>E)Testes