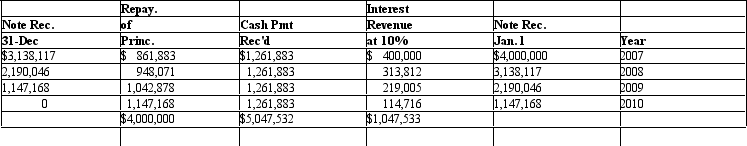

Folio Corp. Folio Corp. sold a paper machine to Library Inc. on January 1, 2007. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Folio to manufacture. Library will make four payments at the end of each year, beginning with 2007, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below: If Folio Corp. is certain that it will collect all four payments from Library Inc. what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is certain that it will collect all four payments from Library Inc. what amount of gross profit should Folio recognize in 2007 from the sale?

Definitions:

Lower of Cost or Market (LCM)

Lower of Cost or Market (LCM) is an accounting principle requiring inventory to be recorded at the lower of its historical cost or current market value to reflect any decrease in the value of inventory.

Ending Inventory Costs

The total value of all the goods that a company has in stock at the end of an accounting period, before any adjustments or cost of goods sold calculations.

LIFO Periodic Inventory Method

An inventory valuation method where the last items purchased are the first items considered sold during a given period, calculated periodically.

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated before any adjustments for cost of sales.

Q7: Net Devices Inc. The following balance sheets

Q12: Under the _, firms begin with net

Q22: HighTech Company HighTech Company manufactures computer

Q26: Under the fair value method of accounting

Q36: The amount initially paid to acquire an

Q47: The _ represents the value of the

Q51: Estrogen<br>A)Adrenal cortex<br>B)Adrenal medulla<br>C)Ovaries<br>D)Pituitary gland<br>E)Testes

Q59: Large current ratios indicate the availability of

Q71: Failure to give reasonable care to a

Q135: A laboratory procedure used to test for