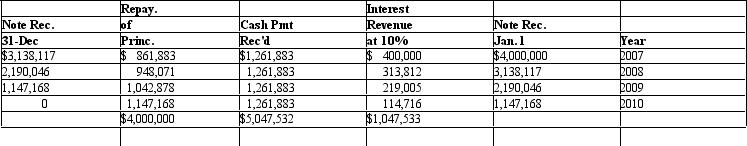

Folio Corp. Folio Corp. sold a paper machine to Library Inc. on January 1, 2007. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Folio to manufacture. Library will make four payments at the end of each year, beginning with 2007, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below: If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the installment method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the installment method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

Definitions:

Highly Liquid

Assets that can be easily converted into cash with minimal impact on their value.

Direct Method

A method of presenting the operating activities section of the statement of cash flows that reports components of cash flows from operating activities as gross receipts and gross payments.

Accounts Receivable

Represents money owed to a company by its customers for goods or services delivered but not yet paid for.

Indirect Method

A way of calculating cash flows for operational activities by starting with net income and adjusting for non-cash transactions.

Q4: Common shareholders benefit with increasing proportions of

Q9: The receipt of cash when employees exercise

Q11: Acquisition costs includes all costs necessary to

Q14: The value-to-book model indicates that a firm

Q14: The document designed to protect phlebotomists from

Q22: Under current GAAP unrealized gains and losses

Q23: Firms recognize an _ when the carrying

Q34: Wolverwine Company's current stock price is $45

Q37: One problem with debt ratios is that

Q46: Increased employment of phlebotomists in home health