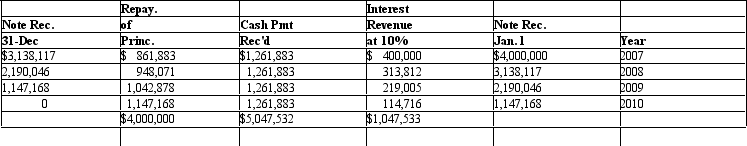

Folio Corp. Folio Corp. sold a paper machine to Library Inc. on January 1, 2007. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Folio to manufacture. Library will make four payments at the end of each year, beginning with 2007, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below: If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

Definitions:

Operating Assets

Assets that a business uses for its day-to-day operational activities to generate revenue, excluding investment and non-operational assets.

Return on Investment

A financial ratio that calculates the profitability of an investment by dividing the net profit by the initial cost of the investment.

Controllable Margin

The portion of profit or income that a manager can directly influence by controlling costs or increasing sales.

Invested Capital

Funds invested in a company by the shareholders and lenders, used for the purchase of assets and operation of the company, aiming for business growth and profitability.

Q3: A company is expected to generate $125,000

Q10: A phlebotomist with a question concerning the

Q17: Investors have invested $25,000 in common equity

Q19: When should an analyst use nominal cash

Q28: Gains and losses differ from revenues and

Q31: Examine the five following cases and determine

Q40: Which of the following is not an

Q46: Impetigo<br>A)Contagious bacterial infection<br>B)Hard protein<br>C)Inflammation of sebaceous glands<br>D)Melanoma<br>E)Oily

Q63: Most medical errors are the result of

Q117: Endocrine glands secrete hormones:<br>A) into the lymphatic