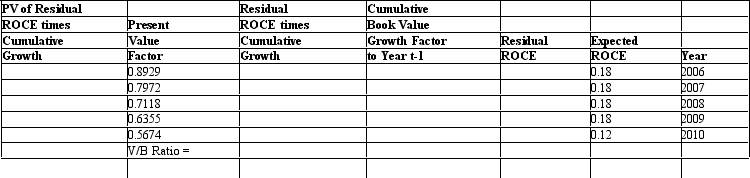

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 12 percent. Assume that the analyst forecasts that the firm will earn ROCE of 18 percent until year 2010, when the firm will start earning ROCE equal to 12 percent. The company pays no dividends and will not engage in any stock transactions. Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Level II Code

In healthcare billing in the United States, Level II codes refer to the HCPCS codes used to identify products, supplies, and services not included in the CPT codes, such as ambulance services and prosthetic devices.

CPT Manual

The Current Procedural Terminology manual, a comprehensive listing of medical procedural codes used by healthcare providers to report and bill medical services and procedures.

E/M

Stands for Evaluation and Management; coding used in healthcare to categorize and bill for patient visits and consultations.

New

Describes something that has recently been created, discovered, or introduced, often implying novelty or innovation.

Q1: A disadvantage of the free cash flow

Q1: Application of the LIFO and FIFO inventory

Q19: When should an analyst use nominal cash

Q27: When evaluating the quality of accounting information

Q27: A leading cause of cancer deaths, which

Q28: Which of the following is not one

Q40: A company that has a cost structure

Q41: A firm's value-to-book and market-to-book ratios may

Q51: A gradual bilateral hearing loss of low

Q62: Acute or chronic hyperventilation can cause:<br>A) Respiratory