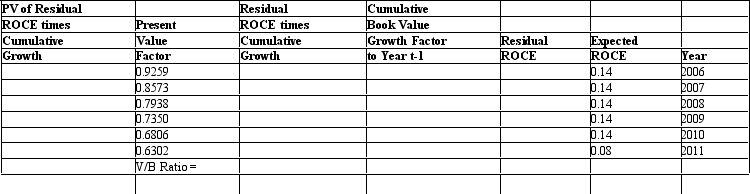

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent. Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2011, when the firm will start earning ROCE equal to 8 percent. The company pays no dividends and will not engage in any stock transactions. Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Education

The process of facilitating learning, or the acquisition of knowledge, skills, values, beliefs, and habits through various means including teaching, training, and research.

U.S. GNP

Gross National Product of the United States, which is the total market value of all final goods and services produced by residents of the country within a specific time period, regardless of production location.

American Doctor

A licensed medical practitioner in the United States qualified to diagnose and treat illnesses, injuries, and other health conditions.

Net Exports

The net trade balance of a country, calculated by subtracting its total imports from its total exports.

Q3: Investors have invested $25,000 in common equity

Q6: Refer to the financial statement data for

Q8: The beta coefficient measures the _ of

Q9: The PEG ratio does not take into

Q10: A chancre appears in the primary stage

Q16: J. Jill is a women's clothing retailer.

Q22: Under current GAAP unrealized gains and losses

Q42: Peptic ulcers:<br>A) Are found in the stomach

Q46: Discuss how the following three elements of

Q60: Orca Industries Below are the two most