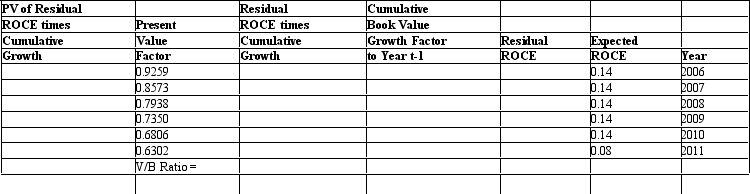

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent. Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2011, when the firm will start earning ROCE equal to 8 percent. The company pays no dividends and will not engage in any stock transactions. Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Programs

Organized groups of activities or services designed to achieve specific outcomes or meet certain needs.

Multicultural Society

A society characterized by the presence and interaction of people from diverse cultural, ethnic, and national backgrounds.

Barrier

An obstacle that prevents progress or access, either physically or metaphorically.

After-school Activities

Organized programs or clubs that students can participate in outside of the regular school hours, which may include sports, arts, and academic clubs.

Q15: Normally, valuation methods are designed to produce

Q32: Surgery is sometimes required to dilate a

Q32: Which of the following activities reported in

Q33: Residual income valuation focuses on _ as

Q38: Hepatitis B is transmitted by blood or

Q41: On a common size basis, which of

Q45: When an analyst uses measures of past

Q46: Accounting information should be a fair and

Q47: Discuss operating, investing and financing cash flows

Q58: Epididymitis is an inflammation of the epididymis