Jones Corp. Use this information to answer the following questions:

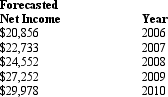

At the end of 2005 Jones Corp. developed the following forecasts of net income: Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Compute the value of Jones Corp. on January 1, 2006, using the residual income valuation model. Use the half-year adjustment.

Definitions:

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific activities, providing a more accurate reflection of costs.

Direct Labor-Hours

Direct labor-hours are the total hours worked by employees directly involved in the manufacturing process.

Direct Materials Cost

The cost of raw materials used to produce a product, which are directly attributable to the product.

Direct Labor-Hours

The combined working hours of employees directly contributing to the manufacturing cycle.

Q8: Net Devices Inc. The following balance sheets

Q10: Nystagmus can be either congenital or acquired.

Q17: Permanent tax differences are revenues and expenses<br>A)

Q29: Presented below is pension information related to

Q37: Accounting information should provide relevant information to

Q47: A change in the _ or _

Q50: Derivative instruments acquired to hedge exposure to

Q53: One cause of pelvic inflammatory disease includes:<br>A)

Q53: Below is financial information for two sporting

Q65: Asset turnover represents<br>A) The ability of the