Jones Corp. Use this information to answer the following questions:

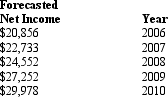

At the end of 2005 Jones Corp. developed the following forecasts of net income: Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

What would be Jones' common shareholders' equity at the end of 2009?

Definitions:

Income Summary

An account used in the closing process that summarizes the revenues and expenses of an accounting period, to determine the net income or loss.

Ratio Based

A method or analysis that involves the comparison of two or more numbers to evaluate the performance, condition, or relationship of different financial aspects of a business.

Net Income

The net income of a business following the subtraction of all costs and taxes from its total revenue.

Capital Balances

This represents the amount of funds that shareholders have invested in a company, often reflected in the equity section of a balance sheet.

Q2: A company with a market beta of

Q16: Assume that you are currently negotiating a

Q18: Jaundice<br>A)Formation of numerous small masses on a

Q18: The cause of prostatitis is:<br>A) STDs.<br>B) Bacteria.<br>C)

Q23: Financial statement forecasts rely on additivity within

Q29: Operating income is negative in an amount

Q44: Esophageal adenocarcinoma is the fastest growing cancer

Q45: Renal cell carcinoma is the most common

Q49: NOTE: The following multiple choice questions require

Q55: Which of the following companies would you