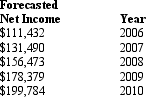

Builder, Inc. is a distributor of tools and building supplies. Management for the company has developed the following forecasts of net income:

Management expects net income to grow at a rate of 7 percent per year after 2010 and the company's cost of equity capital is 14%. Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy. Builder's common shareholders' equity at January 1, 2006 is $544,902.

Management expects net income to grow at a rate of 7 percent per year after 2010 and the company's cost of equity capital is 14%. Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy. Builder's common shareholders' equity at January 1, 2006 is $544,902.

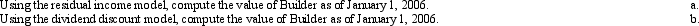

Required:

Definitions:

Competitive Advantage

A situation or factor that places a company in an advantageous or dominant position over its rivals in the business.

SWOT Analysis

A strategic planning technique used to identify and assess Strengths, Weaknesses, Opportunities, and Threats.

Blue Ocean Strategy

A marketing theory that suggests companies are better off searching for ways to gain "uncontested market space" than competing with similar companies.

Differentiation

Differentiating a product or service to enhance its appeal to a chosen market segment.

Q15: Orca Industries Below are the two most

Q16: Occult blood<br>A)Formation of numerous small masses on

Q17: Inflammation of the paranasal cavities is:<br>A) Bronchiectasis.<br>B)

Q23: Renal calculi are:<br>A) An uncommon cause of

Q26: What three financial statements are prepared by

Q29: WACC<br>An analyst wants to value the sum

Q51: Three common types of aneurysms are:<br>A) Abdominal,

Q52: One factor that may cause cash flow

Q62: Normally, intense rivalries have a tendency to

Q64: An acute or chronic inflammation of the