Jones Corp. Use this information to answer the following questions:

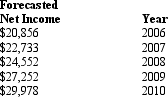

At the end of 2005 Jones Corp. developed the following forecasts of net income: Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

What would be Jones' common shareholders' equity at the end of 2009?

Definitions:

Predetermined Overhead Rate

Predetermined Overhead Rate is a rate calculated before a period begins, used to allocate estimated overhead costs to products or job orders based on a selected activity base.

Annual Overhead Costs

Refers to the total expenses that are not directly tied to a specific product or service but are required for the business to operate, accumulated over a year.

Direct Labor Costs

The wages paid to workers who are directly involved in the production of goods or the provision of services.

Indirect Labor

Labor costs associated with support work that does not directly contribute to the manufacture of products or the provision of services, such as maintenance and supervisory wages.

Q5: Industries with relatively high market-to-book ratios are

Q7: _ activities relate to the normal operations

Q7: NOTE: This problem requires present value

Q9: Net Devices Inc. The following balance sheets

Q14: When evaluating the quality of accounting information

Q18: Net income equals revenues plus _ minus

Q19: Obtaining a competitive advantage by being the

Q36: How easily can customers switch to substitute

Q39: If an analyst wants to value a

Q63: Cor pulmonale:<br>A) Is fatal.<br>B) Cannot be prevented.<br>C)