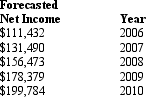

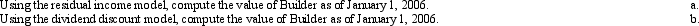

Builder, Inc. is a distributor of tools and building supplies. Management for the company has developed the following forecasts of net income:

Management expects net income to grow at a rate of 7 percent per year after 2010 and the company's cost of equity capital is 14%. Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy. Builder's common shareholders' equity at January 1, 2006 is $544,902.

Management expects net income to grow at a rate of 7 percent per year after 2010 and the company's cost of equity capital is 14%. Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy. Builder's common shareholders' equity at January 1, 2006 is $544,902.

Required:

Definitions:

Passive Portfolio

An investment strategy that seeks to replicate and hold a market index or benchmarks, typically requiring less frequent trading and lower fees.

Market Timing

Asset allocation in which the investment in the market is increased if one forecasts that the market will outperform T-bills.

Alpha Forecasts

Estimates or predictions of the active return on an investment, indicating how a security or portfolio is expected to perform relative to a benchmark index.

Forecast Imprecision

The degree of uncertainty or potential error in predicting future values or outcomes, often associated with economic, financial, or statistical forecasts.

Q1: The acquisition of new investments would be

Q11: Acquisition costs includes all costs necessary to

Q21: For each of the following companies determine

Q24: When preparing the statement of cash flows

Q30: The collapse or airless condition of all

Q35: Continuing free cash flows represent<br>A) the cash

Q36: Thrush is a yeast infection often found

Q41: Below is information from the statement of

Q46: Which of the following would not be

Q52: Note that this topic is covered in