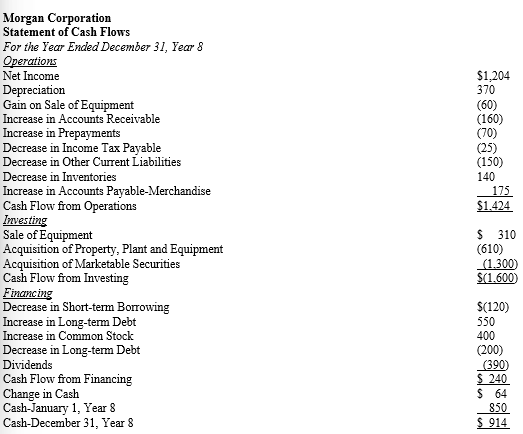

Below is an Income Statement and a Statement of Cash Flows for Morgan Corporation for Year 8.

Required:

Required:

Respond to each of the following questions.

a. Compute the amount of cash collected from customers during Year 8.

b. Compute the amount of cash paid to suppliers for merchandise during Year 8.

c. Compute the amount of income taxes paid to governmental agencies during Year 8.

d. Property, plant and equipment (at cost) had a balance of $3,700 on January 1, Year 8 and $3,940 on December 31, Year 8. Accumulated depreciation had a balance of $1,290 on January 1, Year 8 and $1,540 on December 31, Year 8. Give the journal entry that Morrissey Corporation made in its accounting records during Year 8 to record the sale of the equipment.

e. The balance in the retained earnings account on December 31, Year 8 after closing entries was $1,154. Compute the balance in the retained earnings account on January 1, Year 8.

Definitions:

Ethmoid Bone

A delicate, spongy bone located between the eyes, forming part of the nasal cavity and the orbits of the eyes.

Special Senses

The senses that have specialized organs devoted to them, including vision, hearing, taste, and smell.

Obturator Foramen

The obturator foramen is a large opening in the pelvic bone through which nerves and blood vessels pass.

Bony Features

Characteristics or structures formed by bone, such as projections, depressions, and openings, that serve as sites for muscle attachment or passages for nerves and blood vessels.

Q5: Assume that a firm uses the accrual

Q31: The sum of net income and other

Q64: What are the steps in preparing pro

Q76: The total assets turnover ratio indicates<br>A)the sales

Q85: When using the allowance method<br>A)the write-off of

Q87: Prepaid assets are valued on the balance

Q87: Firms use long-term financing for<br>A)assets they expect

Q90: Describe income recognition after the sale when

Q126: Bad Debt Expense is also called the

Q130: For each of the following independent