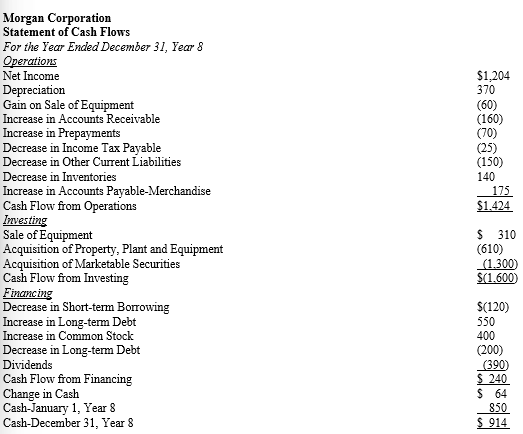

Below is an Income Statement and a Statement of Cash Flows for Morgan Corporation for Year 8.

Required:

Required:

Respond to each of the following questions.

a. Compute the amount of cash collected from customers during Year 8.

b. Compute the amount of cash paid to suppliers for merchandise during Year 8.

c. Compute the amount of income taxes paid to governmental agencies during Year 8.

d. Property, plant and equipment (at cost) had a balance of $3,700 on January 1, Year 8 and $3,940 on December 31, Year 8. Accumulated depreciation had a balance of $1,290 on January 1, Year 8 and $1,540 on December 31, Year 8. Give the journal entry that Morrissey Corporation made in its accounting records during Year 8 to record the sale of the equipment.

e. The balance in the retained earnings account on December 31, Year 8 after closing entries was $1,154. Compute the balance in the retained earnings account on January 1, Year 8.

Definitions:

Occurrence

An event or incident that takes place, often used in legal and insurance contexts to specify an event covered by a policy or agreement.

Nonoccurrence

The failure or absence of an event or condition that was anticipated or required.

Event

A specific occurrence or happening, often of significance, that takes place at a particular time.

Agreement

A mutual understanding or arrangement between two or more parties outlining terms and conditions for a specific purpose.

Q25: Which of the following is/are not true

Q26: The sales, all on account, of

Q35: On December 31, 2013, the Merchandise Inventories

Q54: Accumulated Other Comprehensive Income<br>A)is a shareholders' equity

Q66: Express the following transactions of Forman's Store,

Q81: U.S.GAAP requires the classification of<br>A)the receipt of

Q98: In assessing the financial condition of a

Q116: Cowden Properties sold a condominium to

Q130: (CMA adapted, Dec 92 #18) The

Q155: A firm using FIFO had a beginning