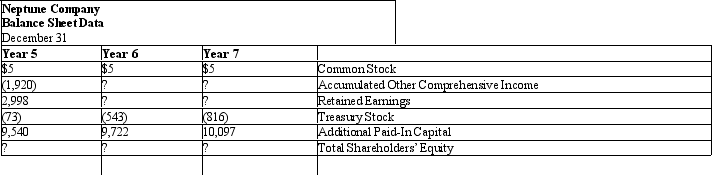

Selected information based on the comparative balance sheets for Neptune Company, a U.S.defense manufacturer, appears in the following display for the years ended December 31, Years 5, 6, and 7.

Neptune applies U.S.GAAP and reports its results in millions of dollars.

Neptune’s other comprehensive income for Year 7 was $774, compared to ($31) in Year 6 and $275 in Year 5. In addition, in Year 7 Neptune made a one-time adjustment of ($1,338) to accumulated other comprehensive income. Comprehensive income for Year 7 was $2,057, compared to $840 in Year 6 and $692 in Year 5. Dividends declared and paid increased from $356 in Year 5, to $394 in Year 6, to $429 in Year 7.

Neptune’s other comprehensive income for Year 7 was $774, compared to ($31) in Year 6 and $275 in Year 5. In addition, in Year 7 Neptune made a one-time adjustment of ($1,338) to accumulated other comprehensive income. Comprehensive income for Year 7 was $2,057, compared to $840 in Year 6 and $692 in Year 5. Dividends declared and paid increased from $356 in Year 5, to $394 in Year 6, to $429 in Year 7.

Required: Compute the missing amounts for each of the three years.

(amounts in millions of US$)

Definitions:

Intermediate Goods

Products used in the production process to make other goods, not including raw materials.

Final Goods

Products that have completed the manufacturing process and are ready for use by consumers or to be sold as finished goods.

GDP

The total value of all ultimate goods and services generated within a country during a designated period is known as the Gross Domestic Product.

GDP Deflator

An economic metric that converts output measured at current prices into constant-price output, making it possible to compare the real value of aggregate production across different periods.

Q6: Rock Aerospace Company signed a

Q12: U.S.GAAP and IFRS require firms to initially

Q18: The _ uses only sales revenues and

Q66: Express the following transactions of Forman's Store,

Q69: <b>Devlin Company </b><br>Devlin Company<br>Statement of Financial

Q75: Manufacturing overhead include(s):<br>A)costs that the firm cannot

Q101: To calculate the amount of net income

Q104: What are common-size income statements?

Q115: The _ are linked (that is, they

Q136: Firms recognize revenue<br>A)when they have completed an