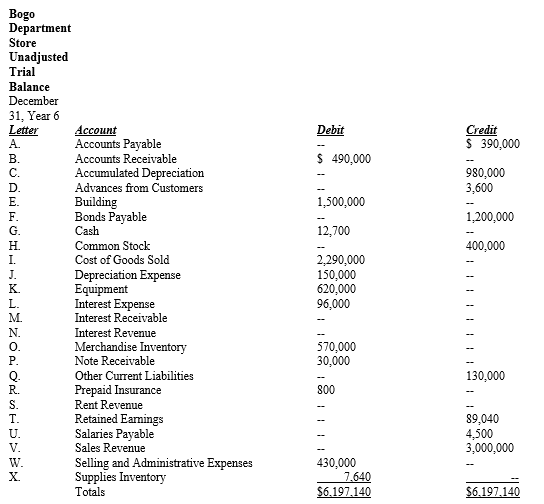

On the next page is the unadjusted trial balance of Bogo Department Store on December 31, Year 6.The company closes its books annually.You are asked to indicate the adjusting entries required on December 31, Year 6 to conform the books to accrual accounting principles.

1. Bogo neglected to record unpaid charges for telephone services for December in the amount of $13,700.

2. The balance in the Advances from Customers account represents the amount received from a lessee on November 1, Year 6 for the rental of excess warehouse space owned by Bogo. The rental period is for the six months ended April 30, Year 7.

3. Bogo acquired a warehouse on July 1, Year 6 and correctly recorded the acquisition cost of $600,000 in its accounts. The warehouse has a 30-year estimated life and zero salvage value. Bogo neglected to record depreciation on the warehouse, although it has correctly recorded depreciation on all other depreciable assets for Year 6.

4. Bogo debited Selling and Administrative Expenses for salaries paid during Year 6. Salaries remaining unpaid as of December 31, Year 6 total $3,700.

5. Sales made on account during the last two days of December, Year 6 totaled $12,000. Bogo incorrectly recorded these sales by debiting accounts payable. These accounts had not been collected by year end.

6. Bogo sold a piece of equipment during Year 6 for $1,800 that had originally cost $6,000 and had accumulated depreciation of $4,200. Bogo recorded this sale by debiting Cash for $1,800 and crediting Equipment for $1,800.

7. The balance in the Prepaid Insurance account represents the balance as of January 1, Year 6. Bogo renewed its only insurance policy on March 1, Year 6 and charged the one-year premium of $5,100 to Selling and Administrative Expenses.

8. A physical inventory of store supplies on December 31, Year 6 revealed that supplies costing $1,850 were on hand.

9. The note receivable was received from a corporate officer on December 1, Year 6. The note bears interest at 6 percent. The interest is payable with the principal amount borrowed at maturity on June 1, Year 7.

Required:

Indicate the letters in the unadjusted trial balance corresponding to the accounts debited and credited and the amount in each debit and credit entry.Use only the accounts listed in the unadjusted trial balance.More than one account may be debited or credited in a particular adjusting entry.If no adjusting entry is needed, indicate "No Entry" by the number of the entry.Remember that asset increases and liability and shareholders' equity decreases are recorded with debits and asset decreases and liability and shareholders' equity increases are recorded with credits.

Definitions:

Authoritarian

A governing system characterized by strong central power and limited political freedoms, where individual rights are often subordinate to the state's authority.

Sovereign Request

A formal petition or demand made by a sovereign state or its representative, often pertaining to diplomatic or legal issues.

Initiative

A process that allows citizens to propose legislation or state constitutional amendments by petition.

Uneducated Mob

A disparaging term for a group of people acting disorderly or violently with little understanding or awareness of the issues at hand.

Q26: The qualitative characteristics describe the attributes that

Q30: T-accounts<br>A)summarize the effects of transactions on specific

Q37: The matching convention assigns _ to the

Q42: Marcus Corporation, a British firm, has an

Q79: One firm may have a lower earnings

Q100: The balance sheet equation shows the equality

Q109: Complete the shareholders' equity section for

Q138: Jamison Corporation issued preferred stock totaling $10,000,000

Q155: Explain the accounting for the issuance of

Q174: Young Corporation's capital stock at December 31