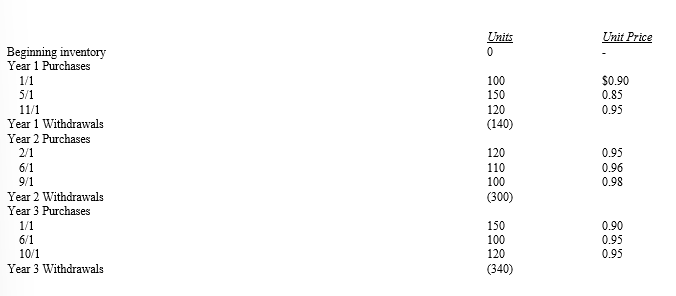

Using U.S.GAAP, a merchandising firm is trying to decide between using LIFO or FIFO for an inventory cost flow assumption.The firm had inventory purchases and sales over 3 years as follows:

The firm estimates that using LIFO will cost the firm $50 for additional clerical work. The tax rate for all years is 30%. Net income before cost of goods sold for each year is as follows:

Year 1 - $1,000

Year 2 - $2,000

Year 3 - $2,500

Required:

a. What is net income after taxes under each method for years 1 through 3?

b. Which method will result in a higher after tax cash flow for each year?

Definitions:

Employment Law

The area of law that deals with the rights and obligations of workers, employers, and labor unions.

Legal Issues

Disputes that arise under the law, requiring legal interpretation and resolution by legal institutions.

Paralegals

Trained legal assistants who support attorneys in a wide range of legal tasks, including research and document preparation but not the practice of law.

Partnership Agreement

A written agreement between business partners outlining the rules and responsibilities within the partnership.

Q12: U.S.GAAP and IFRS require firms to account

Q28: The amortization of bond discount related to

Q40: The cash change equation for preparing the

Q57: When preparing consolidated financial statements, the result

Q72: The value of a stock option results

Q73: Various laws and contracts govern the rights

Q131: Which of the following is not true?<br>A)Gains

Q171: The FASB and the IASB are reconsidering

Q184: The FASB's conceptual framework defines a(n) _

Q228: U.S.GAAP and IFRS provide criteria for distinguishing