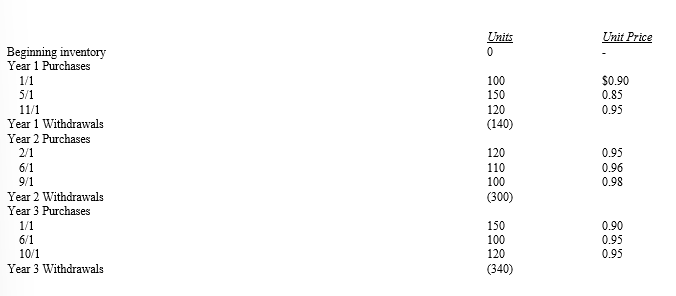

Using U.S.GAAP, a merchandising firm is trying to decide between using LIFO or FIFO for an inventory cost flow assumption.The firm had inventory purchases and sales over 3 years as follows:

The firm estimates that using LIFO will cost the firm $50 for additional clerical work. The tax rate for all years is 30%. Net income before cost of goods sold for each year is as follows:

Year 1 - $1,000

Year 2 - $2,000

Year 3 - $2,500

Required:

a. What is net income after taxes under each method for years 1 through 3?

b. Which method will result in a higher after tax cash flow for each year?

Definitions:

Order Paper

A negotiable instrument that is payable to a specific individual or entity, as named or identified in the document.

Drawee

The drawee is the party in a financial transaction, usually a bank, upon whom a check or draft is drawn and is responsible for paying the amount specified.

Maker

In financial terms, the party that creates or issues a promissory note, obligating themselves to pay a certain sum to a specified party.

Negotiable Instrument

A document in writing that confirms the payout of a designated amount of money, whether immediately upon demand or at a specific time, with the name of the person paying listed on it.

Q9: Recognition of revenue usually occurs when<br>A)the firm

Q22: The summary of significant accounting principles, a

Q25: The statement of cash flows begin with

Q66: Kendrick Company began the current year

Q68: The first step in the accounting record-keeping

Q103: Which of the following is/are true?<br>A)Preferred shares

Q110: Discuss the indirect and direct methods in

Q117: During Year 5, Taylor Corporation signed a

Q141: Explain the accounting for leases.

Q219: Both U.S.GAAP and IFRS often refer to