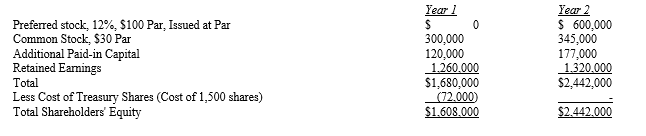

Selected data from the comparative balance sheets of Mock Company as of December 31, Year 1, and Year 2 appear below:

The following transactions occurred during Year 2:

The following transactions occurred during Year 2:

a. March 1, Year 2: The company resold the Treasury shares on the market for $57 per share.

b. June 30, Year 2: The company declared and issued a 10-percent stock dividend at a time when the market price was $63 per share.

c. September 15, Year 2: The company issued additional shares of common stock on the open market for cash.

d. November 16, Year 2: The company issued new preferred shares on the open market for cash.

e. December 31, Year 2: Net income for Year 2 was $195,000. The company declared and paid cash dividends of $72,000 on the last day of the year.

Required:

Prepare journal entries for each of the transactions and events affecting these shareholders' equity accounts during Year 2.

Definitions:

Materials Ledger

A record keeping system that tracks the quantities and costs of raw materials used and on hand in the manufacturing process.

General Ledger

A complete record of all financial transactions over the life of a company, serving as the primary source of information for the financial statements.

Receiving Report

A document usually prepared by the receiving department detailing the goods received by a business, which is then used to verify invoices before payment.

Period Costs

Expenses that are not directly tied to the production of goods or services and are expensed within the period they occur.

Q15: According to U.S.GAAP, firms holding debt securities

Q43: Treasury stock can be defined as<br>A)unissued stock,

Q57: Income tax expense affects assessments of profitability

Q82: In determining cash flows from operations under

Q86: During 2013, Maria Corporation sold marketable securities

Q103: Which of the following is/are true?<br>A)Preferred shares

Q109: Jurisdiction-specific corporate laws limit directors' freedom to

Q116: The product life-cycle concept from microeconomics and

Q122: Excellent Paper, a United States-based company, processes

Q180: Accrual accounting requires frequent, ongoing changes in