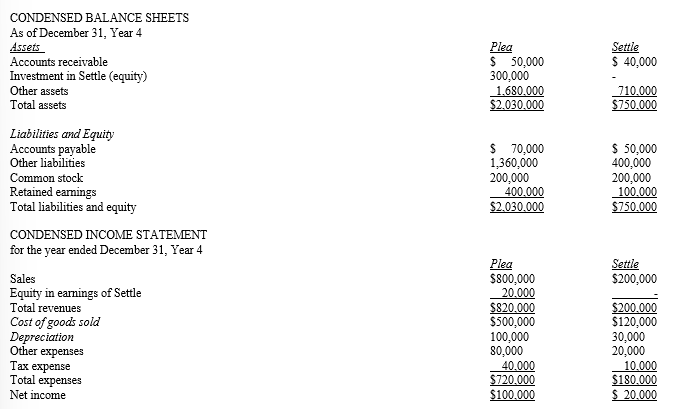

Given the following separate company balance sheets and income statements, answer the following questions.

Additional information:

Plea acquired its investment in the stock of Settle on the date of Settle’s incorporation.

Consolidated accounts receivable is $80,000.

Consolidated sales total $900,000.

No purchases from Settle remain in Plea’s ending inventory.

Required:

a. What percentage of Settle does Plea appear to own?

b. What is beginning retained earnings of Plea?

c. How much was Plea’s initial investment in Settle?

d. What is the amount of intercompany accounts receivable?

e. What is consolidated cost of goods sold?

Definitions:

Periodic Basis

A method of accounting where financial and inventory records are updated at regular, fixed intervals.

Resale Value

The expected price at which an asset can be sold in the market after it has been used.

Incremental Costs

The additional costs incurred when a company increases production by one unit.

Special Order

An order that deviates from the normal production process or product line, often requiring special pricing and handling.

Q3: In 2013, Kentucky Inc. purchased stock as

Q15: U.S.international companies always have an effective tax

Q63: What factors enter into choosing the accounting

Q72: Which of the following is true regarding

Q97: Describe comprehensive income, net income, and other

Q108: Managers frequently cite which of the following

Q126: Which of the following is/are not true

Q146: The accounting for employee stock options involves

Q199: The par value of common stock represents

Q232: What are the financial reporting objectives?