Financial ratios

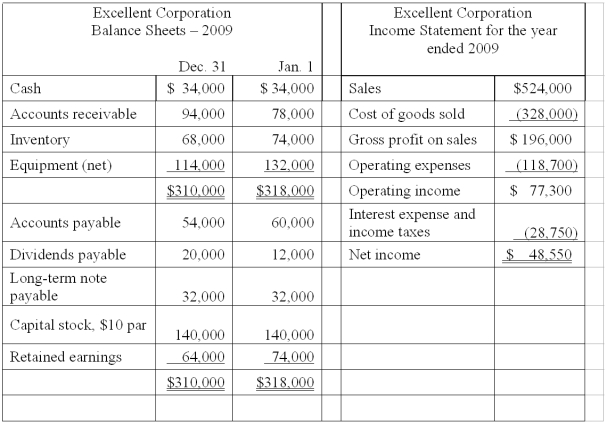

Given below are comparative balance sheets and an income statement for the Excellent Corporation:

All sales were made on account. Cash dividends declared during the year totaled $58,550. Compute the following:

Definitions:

Uncertainty Avoidance

A cultural dimension that describes how societies deal with the unknown, with high avoidance indicating a preference for clear rules and low avoidance reflecting more comfort with ambiguity.

Cultural Relativism

The perspective that beliefs, morals, and ethics are relative to each individual within his or her own social context.

Society

A group of individuals involved in persistent social interaction, or a large social grouping sharing the same geographical or social territory, typically subject to the same political authority and dominant cultural expectations.

Behavioral Economics

A field of economic research that examines the effects of psychological, social, cognitive, and emotional factors on economic decisions.

Q15: Large stock dividends tend to:<br>A) Increase stock

Q32: Eaton Company has some assets that provide

Q36: The Foreign Corrupt Practices Act (FCPA) imposes

Q38: Tuliptime, Inc. sold American fashions to a

Q84: The number of shares a corporation may

Q109: A corporation is a legal entity separate

Q119: A liquidating dividend:<br>A) Occurs only when a

Q128: The following information is based on the

Q130: Interpreting stockholders' equity section<br>The stockholders' equity

Q149: Treasury stock appears as:<br>A) An asset account.<br>B)