Financial ratios

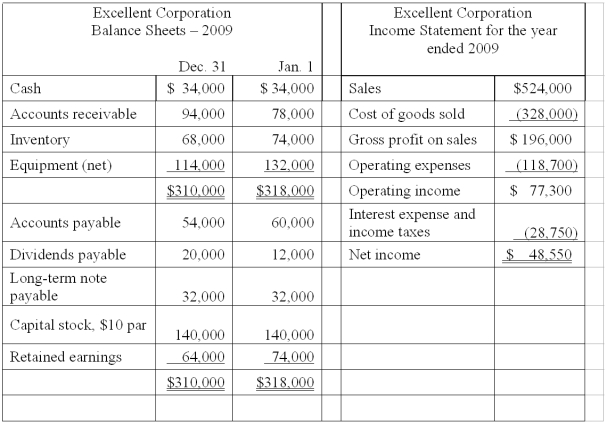

Given below are comparative balance sheets and an income statement for the Excellent Corporation:

All sales were made on account. Cash dividends declared during the year totaled $58,550. Compute the following:

Definitions:

Market Rate

The prevailing interest rate available in the marketplace on deposits, debts, or loans.

Nominal Rate

The Nominal Rate is the interest rate stated on a loan or financial product, not taking into account inflation or other factors that could affect the real value of the interest.

Premium

An amount paid in excess of a standard price or value, often related to insurance policies, bonds above par, or quality products.

Annual Amortization

The process of spreading out a loan or intangible asset cost over a specific period of time for accounting and tax purposes.

Q16: To convert a foreign currency into dollars,

Q38: Compute the cash payments for operating expenses.<br>A)

Q49: The managers of a business prepare financial

Q49: Alexander Company reported an increase of $185,000

Q57: The cash proceeds received by Korman Corporation

Q86: If Xanadu Fashions had reacquired 35,000 shares

Q95: A small stock dividend of 5,000 shares

Q119: The ratio which measures total liabilities as

Q124: If a corporation has issued a single

Q150: Royal Corporation uses the indirect method of