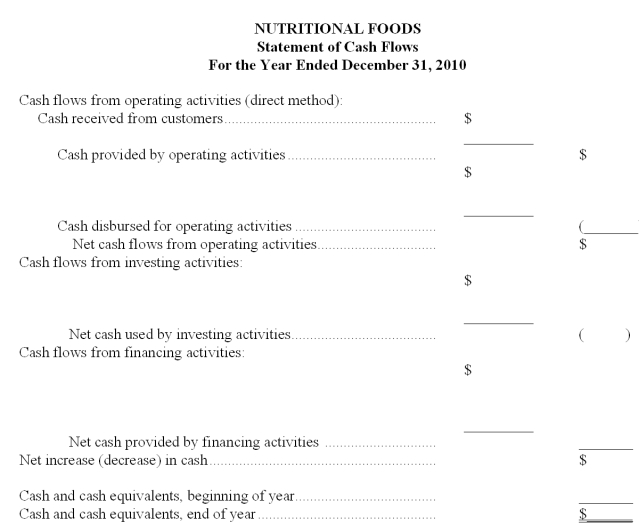

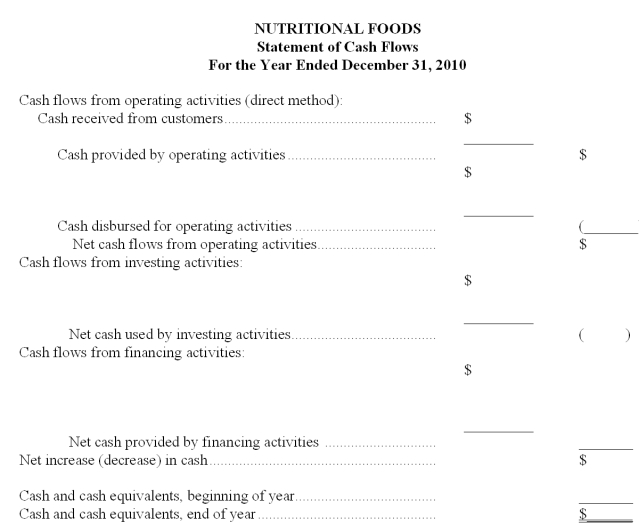

Using the following information, complete the statement of cash flows for Nutritional Foods for the year ended December 31, 2010. Place parentheses around those figures in the statement representing cash outlays.

Payments for purchase of land Proceeds from sale of land. Proceeds from issuance of capital stock Proceeds from issuance of bonds payable Payments to settle short-term debt. Interest and dividends received. Cash received from customersDividends paid Cash paid to suppliers and employees Interest paid Income taxes paid Cash and cash equivalents, January 1, 2010 Cash and cash equivalents, December 31, 2010. $416,000$58,000$347,000$99,000$74,000$49,000$1,502,000$182,000$1,172,000$66,000$115,500$86,000?

Learn about the requirements and implications of the acquisition method for consolidated financial statements.

Recognize the recognition and allocation of excess purchase price over book value in business combinations.

Understand the principles of joint ventures and the application of the equity method in such arrangements.

Understand the accounting treatment and financial impact of purchase price allocation in business combinations, including excess cost allocations and goodwill calculation.

Definitions:

Specific Accounting Principles

Guidelines that govern the accounting process for specific transactions and events, tailored to particular industries or sectors.