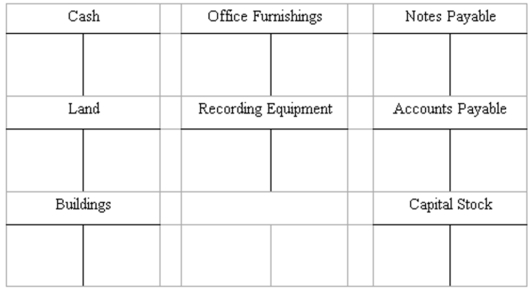

Recording transactions in T accounts; trial balance

On May 15, George Manny began a new business, called Sounds, Inc., a recording studio to be rented out to artists on an hourly or daily basis. The following six transactions were completed by the business during May:

(A.) Issued to Manny 5,000 shares of capital stock in exchange for his investment of $200,000 cash.

(B.) Purchased land and a building for $410,000, paying $100,000 cash and signing a note payable for the balance. The land was considered to be worth $310,000 and the building $100,000.

(C.) Installed special insulation and soundproofing throughout most of the building at a cost of $120,000. Paid $32,000 cash and agreed to pay the balance in 60 days. Manny considers these items to be additional costs of the building.

(D.) Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies. Sounds paid $28,000 cash with the balance due in 30 days.

(E.) Borrowed $180,000 from a bank by signing a note payable.

(F.) Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at May 31 by completing the form provided.

SOUNDS, INC.

Trial Balance

May 31, 20__

Debit Credit

Definitions:

Northeastern Cities

Urban areas located in the northeastern region of the United States, characterized by their historical significance and economic development.

Desegregated Units

Military or organizational units where members of different racial backgrounds are integrated, as opposed to segregated units.

Zoot Suit Riots

1943 riots in which sailors on leave attacked Mexican-American youths.

Racial Tolerance

The acceptance and respect towards individuals regardless of their race, fostering a society where racial discrimination and prejudice are minimized.

Q34: The primary objective of the statement of

Q38: If cost of goods sold is $480,000

Q46: The purpose of the after-closing trial balance

Q54: The information is historical in nature. It

Q59: According to attendance records, $8,200 of the

Q106: Financial accounting information is:<br>A) Designed to assist

Q120: The accrued interest should be:<br>A) Debited to

Q121: Financial statements are designed primarily to:<br>A) Provide

Q137: A net profit results from having more

Q148: An expense is best defined as:<br>A) Any