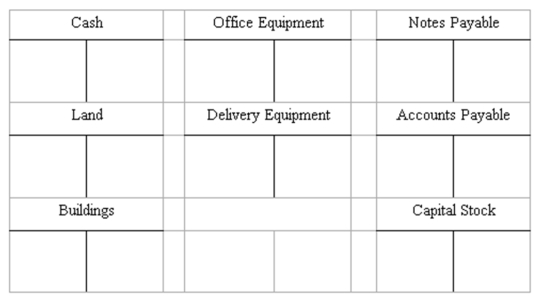

Recording transactions directly in T accounts; trial balance

On July 20, Mollie Rose began a new business called MR Printing, which provides typing, duplicating, and printing services. The following six transactions were completed by the business during July.

(A.) Issued to Rose 1,000 shares of capital stock in exchange for her investment of $200,000 cash.

(B.) Purchased land and a small building for $450,000, paying $165,000 cash and signing a note payable for the balance. The land was considered to be worth $240,000 and the building $210,000.

(C.) Purchased office equipment for $30,000 from Quality Interiors, Inc. Paid $17,000 cash and agreed to pay the balance within 60 days.

(D.) Purchased a motorcycle on credit for $3,400 to be used for making deliveries to customers. Mollie agreed to make payment to Spokes, Inc. within 10 days.

(E.) Paid in full the account payable to Spokes, Inc.

(F.) Borrowed $30,000 from a bank and signed a note payable due in six months.

Instructions

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at July 31 by completing the form provided.

MR PRINTING

MR PRINTING

Trial Balance

July 31, 20

Debit Credit

Definitions:

Labor Demand

Refers to the total hours that employers want to hire at a given wage rate.

Highly Skilled Workers

Individuals with extensive training and expertise in particular fields, often requiring advanced education or specialized experience.

Household Income

The total amount of income earned by members of a household, including wages, salaries, benefits, and other income streams.

Total Income

The sum of all earnings or revenues received by an individual or organization, including wages, salaries, investment returns, and other sources.

Q4: Dividends are an expense to a corporation

Q24: If Capital Stock is $320,000, total assets

Q28: The future amount of an annuity is

Q32: A note that does not include an

Q32: The worksheet:<br>A) Is one of the basic

Q37: Rose Corp. has a note receivable from

Q43: The balance in the Inventory account at

Q95: Adjusting entries are only required when errors

Q122: Publicly owned companies are:<br>A) Managed and owned

Q123: The basic purpose of offering customers cash