Recording transactions in T accounts; trial balance

On May 15, George Manny began a new business, called Sounds, Inc., a recording studio to be rented out to artists on an hourly or daily basis. The following six transactions were completed by the business during May:

(A.) Issued to Manny 5,000 shares of capital stock in exchange for his investment of $200,000 cash.

(B.) Purchased land and a building for $410,000, paying $100,000 cash and signing a note payable for the balance. The land was considered to be worth $310,000 and the building $100,000.

(C.) Installed special insulation and soundproofing throughout most of the building at a cost of $120,000. Paid $32,000 cash and agreed to pay the balance in 60 days. Manny considers these items to be additional costs of the building.

(D.) Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies. Sounds paid $28,000 cash with the balance due in 30 days.

(E.) Borrowed $180,000 from a bank by signing a note payable.

(F.) Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

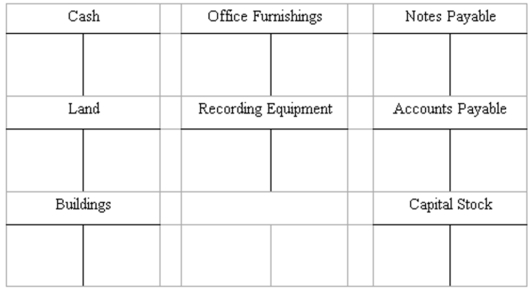

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at May 31 by completing the form provided.

SOUNDS, INC.

Trial Balance

May 31, 20__

Debit Credit

Definitions:

At-Risk Youth

Individuals, typically under the age of 18, who are considered to be at a higher risk of facing adverse outcomes such as failing in school, substance abuse, or criminal activity due to their social, economic, or family circumstances.

Unique Customer Experience

A distinctive and memorable interaction between a business and its customers, differentiating it from competitors through personalized service or innovative offerings.

Long-Term Course

Strategic plans or actions that are focused on achieving goals over an extended period rather than immediate or short-term results.

Strategy

A plan of action designed to achieve a long-term or overall goal, often involving setting objectives and determining the best course of action.

Q14: Adjusting entries-effect on elements of financial

Q45: What is the balance in the Cash

Q56: Refer to the information above. The entry

Q57: Return on investment is the same as

Q96: Water world Boat Shop purchased a truck

Q107: Which of the following is reported as

Q118: Unpaid expenses may be included as an

Q122: Cash paid to suppliers under the direct

Q136: Adequate disclosure<br>(A.) Briefly explain what is meant

Q138: If management wants to know the cost