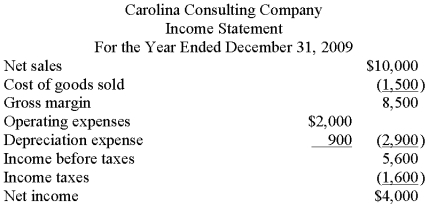

Following are the income statement and some additional information for Carolina Consulting Company.

All sales were on credit and accounts receivable decreased by $900 this year compared to last year. Merchandise purchases were on credit with a decrease in accounts payable of $700 during the year. Ending inventory was $500 larger than beginning inventory. Income taxes payable increased $300 during the year. All operating expenses were paid for in cash.

Required:

Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

Definitions:

Long-Term Debt Rate

The interest rate applied to loans or borrowings with a maturity date extending beyond one year.

Minimum Operating Lease Payments

The minimum amount that a lessee is obligated to pay over the lease term for the right to use an underlying asset, excluding costs such as maintenance and taxes that are paid by the lessee.

Sales-Type Lease

A lease agreement in which the lessor recognizes immediate profit on the leased asset, as if it were sold, typically used in capital leasing.

Operating Lease

A contract allowing the use of an asset without transferring ownership rights, typically with shorter terms than a finance lease.

Q34: To appear in a balance sheet of

Q56: On December 31, 2009, Wellstone Company reported

Q56: What is Rudyard's basic EPS?<br>A)$2.13.<br>B)$4.80.<br>C)$4.00.<br>D)$3.20.

Q57: If the Notes Payable is $10,000, the

Q68: (a.) What is the most significant change

Q80: The valuation of assets in the balance

Q97: What was the average exercise price per

Q100: What is the present value of Ralph's

Q128: January 1, 2009, Hage Corporation granted incentive

Q156: The payment of a business debt not