Use the following to answer questions

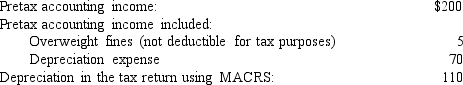

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Franklin's net income ($ in millions) is:

Definitions:

Available-For-Sale Securities

Financial assets that are intended to be sold before their maturity but are not classified as trading securities.

Investment Account

A financial account held at a financial institution or brokerage that is used to hold securities, stocks, bonds, mutual funds, and other investments.

Equity Method

An accounting technique used for recording investments in associated companies, where the investment's carrying value is adjusted to recognize the investor's share of the earnigns or losses of the investee.

Dividends Received

Payments made to shareholders out of a corporation's earnings, representing a share of the profits.

Q20: We record and report most changes in

Q39: Carpenter Inc. had a balance of $80,000

Q53: A company overstated its liability for warranties

Q55: A loss contingency should be accrued in

Q60: The calculation of diluted earnings per share

Q68: The reporting of earnings per share is

Q76: From the perspective of the lessee, leases

Q88: On January 1, 2009, G Corporation agreed

Q113: State and Federal Unemployment Taxes (SUTA and

Q143: What is the annual stated interest rate