In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

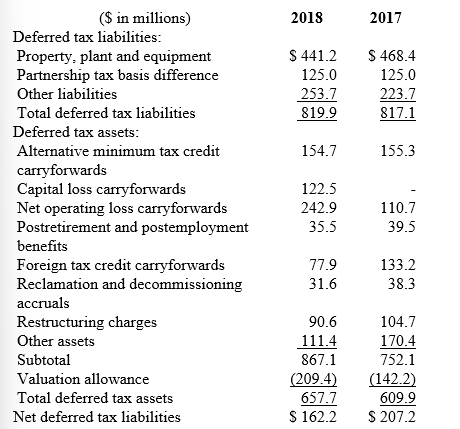

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Explain why LMC has a $209.4 million valuation allowance for its deferred tax assets.

Definitions:

Tender Offer

A financial term referring to a public bid by a person or company proposing to buy shares from shareholders of a public company at a specified price within a certain time.

Full Market Value

The highest price a willing buyer would pay and a willing seller would accept for an asset in an open and competitive market.

Assumed Liabilities

Obligations that a company takes on when it purchases another company or its assets.

Acquiring Assets

The process of obtaining ownership or control of assets, which can include tangible property like real estate or intangible property like intellectual property rights.

Q2: The concept of substance over form influences

Q5: When the interest payment dates are March

Q6: A small stock dividend is defined as

Q25: Compared to the ABO, the PBO usually

Q46: On January 1, 2009, Nana Company paid

Q73: Both trading securities and securities available for

Q78: Pension plans typically require some minimum period

Q81: When a capital lease is first recorded

Q82: If Pop Company owns 15% of the

Q92: What are the three types of expenses