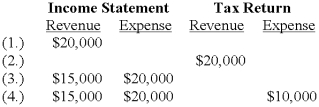

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences reported first on:

Required:

For each situation, determine the taxable income assuming pretax accounting income is $100,000. Show well-labeled computations.

Definitions:

Long-Term Fuel Trims

Adjustments made by a vehicle's engine control unit to the fuel mixture over an extended period to maintain optimal combustion and efficiency.

Current Codes

Refers to the latest set of standards, rules, or guidelines that are in use or being followed in a specific area or industry.

Pending Codes

Diagnostic trouble codes stored by a vehicle's onboard computer that indicate potential issues not yet severe enough to trigger the malfunction indicator light.

DTCs

Abbreviation for Diagnostic Trouble Codes, which refer to the codes generated by a vehicle's onboard diagnostics system indicating specific issues or malfunctions.

Q32: In order to encourage employee ownership of

Q34: Providing a monetary rebate program for purchasing

Q40: Why do companies find the issuance of

Q45: How are deferred tax assets arising from

Q65: On its tax return at the end

Q108: A statement of comprehensive income does not

Q110: A disclosure note from E Corp.'s

Q115: M Corp. recorded a capital lease in

Q117: Future taxable amounts result in deferred tax

Q118: The following selected transactions relate to liabilities