Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

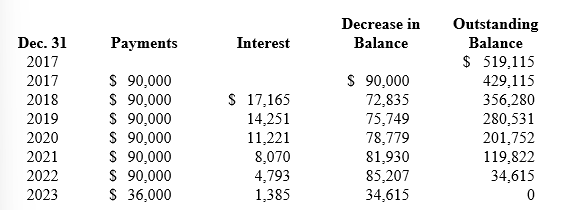

Reagan's lease amortization schedule appears below:

-What is the amount of residual value guaranteed by Reagan to the lessor?

Definitions:

Exporting

The process of sending goods or services to another country for sale.

Port of Contact

A port or harbor where goods, services, and cultural exchanges occur, serving as a point of entry and interaction for different regions or countries.

American Traders

Individuals or entities involved in the commerce of goods and services within the United States, playing a role in both domestic and international trade.

Distinctly American Character

Unique qualities or cultural aspects that define the identity of the United States, including individualism, freedom, and diversity.

Q20: On January 1 of the current reporting

Q24: In its first four years of operations

Q40: When dividends are declared in one fiscal

Q49: The December 31, 2009 balance sheet

Q72: What balance sheet amount would Beresford report

Q99: Bourne, Inc acquired 50% of David Webb

Q104: At December 31, 2009, the account balances

Q105: A company should accrue a loss contingency

Q114: A magazine publisher collects one year in

Q154: The projected benefit obligation may be less